Weekly Wrap Up: October 4 -10, 2025

Weekly Wrap Up: October 4 - 10, 2025

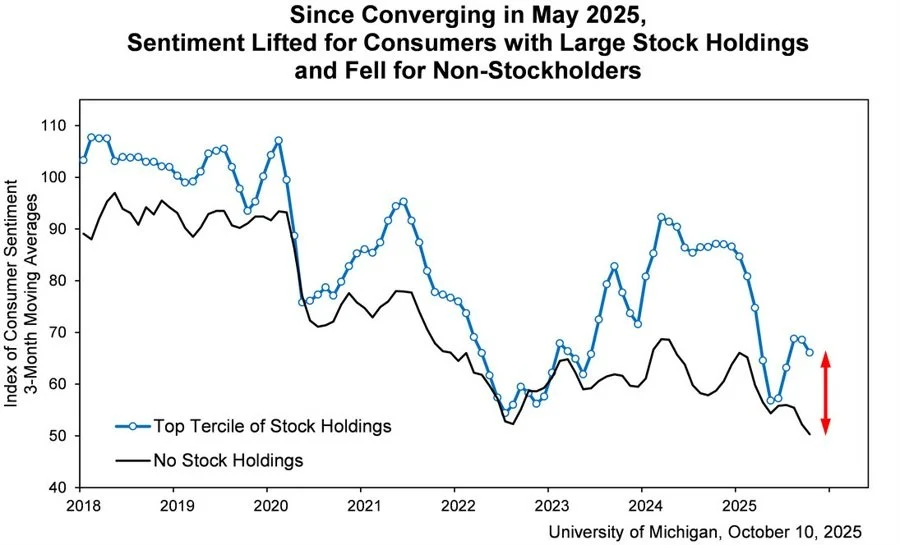

Chart of the Week: Consumer Sentiment

This week’s chart from the University of Michigan’s Consumer Sentiment Survey highlights a striking divergence in confidence between investors and non-investors. Since converging in May 2025, sentiment has lifted sharply for consumers with large stock holdings, while it has fallen further for non-stockholders.

The stock market’s rebound has clearly buoyed optimism among households with equity exposure, but it hasn’t carried over to the broader population. For those without market participation, concerns around affordability, job security, and inflation continue to weigh heavily.

Mark’s Insight: “This chart perfectly captures today’s economic divide—financial markets and Main Street are living in two different realities. For investors, rising equity values have rekindled confidence. For non-investors, everyday financial stress still dominates.

That divergence matters. When market optimism runs ahead of the real economy, it can distort perceptions of growth and resilience. Investors may feel wealthier and spend more freely, while others remain cautious and constrained.

In our view, lasting economic strength will come only when confidence broadens—when optimism is not limited to those with investment portfolios but shared by households across all financial situations. Until then, the story remains one of uneven progress beneath the surface.”

Stocks of the Week – Constellation Energy (CEG)

Constellation was the standout this week, up ~8%. The setup is straightforward: dependable, carbon-free baseload where demand is growing—data centers and utilities. In January, CEG announced a cash-and-stock deal to acquire Calpine: about $16.4B equity value plus ~$12.7B of debt (management frames enterprise value near $26.6B), pending customary approvals. On the fundamentals side, CEG posted adjusted operating EPS of $1.91 (vs. $1.68 a year ago) and reaffirmed full-year adjusted EPS guidance of $8.90–$9.60. Recent wins include a 20-year power purchase agreement with Meta for the full output of the Clinton Clean Energy Center, supporting relicensing and incremental uprates, another data-center-aligned demand signal. Constellation Energy Investor Relations Constellation Energy Q2 2025 Earnings Release Yahoo Finance – CEG Quote & Performance Data

Jackie’s Take: “CEG sits at the intersection of reliable baseload and rising power needs. The chart is doing the talking—RSI is 74, momentum is constructive, and price is pressing highs. I’m watching the 390 area as near-term resistance and the mid-350s as first support. It’s been a solid contributor in our Momentum Portfolio. Consistent operations, clear sector tailwinds, and trend strength are why it stands out on my screen this week.”

Quote of the Week

“Uncertainty is the only certainty there is, and knowing how to live with insecurity is the only security.” — John Allen Paulos

Periods of uncertainty, whether in markets or in life, test our ability to stay grounded in what truly matters. At WWM, we view uncertainty not as something to avoid, but as something to prepare for. Our Gather & Preserve™ framework is designed precisely for times like these—layered, flexible, and guided by both data and discipline. By embracing uncertainty as a constant, we can help our clients navigate change with confidence and stay focused on the long-term outcomes that define success.

What We’re Reading

This week in Essentialism, Greg McKeown describes his practice of taking quarterly offsites—not just for his team, but for himself. He blocks off time away from the day-to-day, free from distractions, to reflect on what truly matters, assess progress toward long-term goals, and prune commitments that no longer align with his highest contribution.

“Every ninety days or so, I take a personal quarterly offsite to ask myself: What is essential right now? What has changed? What needs to be eliminated? What deserves my full focus next?”

— Greg McKeown, Essentialism

McKeown argues that these offsites aren’t a luxury—they’re a discipline. Just as companies need strategy days to reset and recalibrate, individuals need space to step back and see the bigger picture. Without this rhythm of reflection, it’s easy to drift, mistaking motion for progress.

WWM Insight: At WWM, we take a similar approach. Jackie and I regularly step away from the daily routine to reflect, refine, and reimagine how we serve our clients. These intentional strategy sessions allow us to look beyond short-term market noise and focus on improving the processes that help our clients achieve long-term success. We also use this time to prioritize where our energy is best spent—adding value in the ways that most meaningfully impact our ideal clients’ lives.

Disclaimer:

This commentary is provided for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any security. Past performance is not indicative of future results. All investments involve risk, including the possible loss of principal. The views expressed are those of Wolter Wealth Management and are subject to change without notice. Please consult with your financial professional before making any investment decisions.