Weekly Wrap Up: October 11 -17, 2025

Weekly Wrap Up: October 11 - 17, 2025

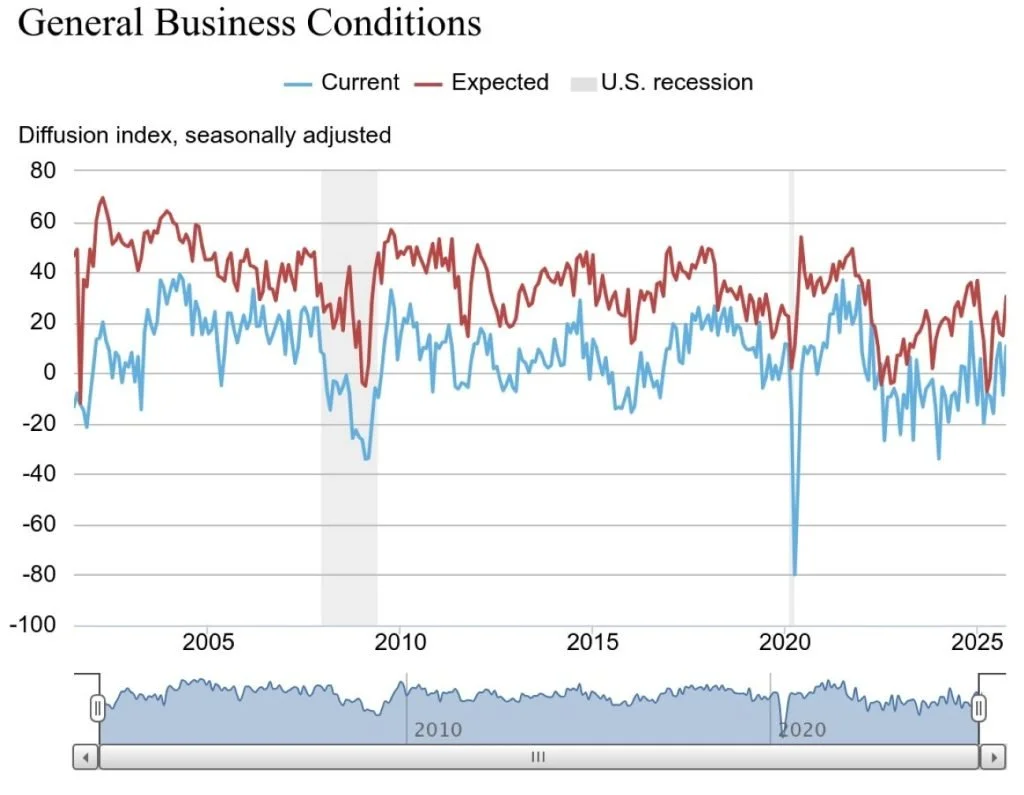

Chart of the Week: Empire State Manufacturing Survey: A Glimmer of Optimism

This week’s chart comes from the New York Federal Reserve’s Empire State Manufacturing Survey, which tracks how manufacturers in New York view current and expected business conditions. The blue line represents current conditions, while the red line reflects expectations six months ahead.

In October, both measures edged higher, with the “current conditions” index rebounding from deeply negative territory and “expectations” continuing to rise. While manufacturing activity remains soft, the improvement in sentiment suggests that companies are beginning to see stabilization as supply chains normalize and input costs ease. The index is often viewed as a leading indicator for the broader U.S. manufacturing sector, making this uptick worth watching.

Mark’s Insight: “We’ve learned that markets often move on expectations — and business leaders are no different. The gap between current reality and future optimism has widened again, a pattern that often signals turning points. Whether this optimism proves justified or premature will depend on how quickly demand firms up heading into year-end, but it’s encouraging to see confidence slowly reappear beneath the surface.”

Stocks of the Week –

+16% this week | Back above 25 for the first time since April

After months of calm, the VIX, often called the market’s “fear gauge,” broke above 25 this week for the first time since April. The index is up roughly 16%, with RSI at 73 and ADX strengthening near 44, confirming a clear momentum shift after months of compression. The move reflects a sudden uptick in hedging activity as traders react to stronger economic data, shifting rate expectations, and renewed geopolitical tension.

But volatility isn’t something to avoid; it’s something to understand. It tells us when fear is entering the market and when opportunity may not be far behind. And that’s the point. Volatility isn’t the problem, it’s the environment where strong strategy shows up.

Jackie’s Take: “Volatility creates opportunity. It’s where emotion meets movement, and that’s where active management earns its value. Our Momentum portfolio is designed to identify these inflection points and lean into strength, while our Gather & Preserve™ framework keeps income steady and long-term goals intact. Periods like this reward discipline and preparation, not comfort.”

Quote of the Week

“To suppose that the value of a common stock is determined purely by a corporation's earnings discounted by the relevant interest rates and adjusted for the marginal tax rate is to forget that people have burned witches, gone to war on a whim, risen to the defense of Joseph Stalin and believed Orson Welles when he told them over the radio that the Martians had landed..” — Jim Grant

WWM Insight: Grant’s observation captures an essential truth about markets — they’re driven as much by emotion and narrative as by math. This week’s uptick in volatility is a perfect reminder: prices reflect human behavior, not just spreadsheets. Our job as investors isn’t to predict emotions but to plan around them — building portfolios that can endure moments of irrationality and capitalize when reason returns.

What We’re Reading

As we’ve moved deeper into Essentialism, one message stands out: clarity of purpose is the antidote to distraction. Around three-quarters through the book, McKeown writes about making execution effortless, simplifying systems and routines so that doing the right thing becomes the default, not the exception.

He describes the importance of designing your environment to support focus rather than relying on willpower alone. The goal isn’t to do more; it’s to make the essentials so clear and streamlined that progress happens naturally.”

WWM Insight: At WWM, we take a similar approach. Jackie and I regularly step away from the daily routine to reflect, refine, and reimagine how we serve our clients. These intentional strategy sessions allow us to look beyond short-term market noise and focus on improving the processes that help our clients achieve long-term success. We also use this time to prioritize where our energy is best spent—adding value in the ways that most meaningfully impact our ideal clients’ lives.

Disclaimer:

This commentary is provided for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any security. Past performance is not indicative of future results. All investments involve risk, including the possible loss of principal. The views expressed are those of Wolter Wealth Management and are subject to change without notice. Please consult with your financial professional before making any investment decisions.