Weekly Wrap Up: Sep 27-Oct 3, 2025 (Copy)

Weekly Wrap Up: Sep 27-Oct 3, 2025

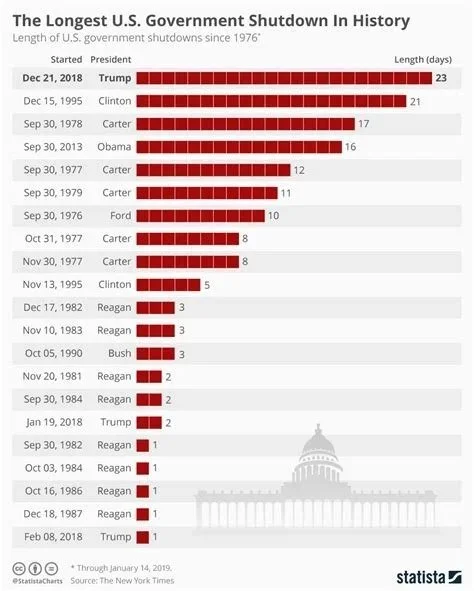

Chart of the Week: Government Shutdowns in Perspective

This week’s chart looks back at the history of U.S. government shutdowns. Most have been resolved quickly, often within days. The exceptions stand out: the 35-day shutdown of 2018–2019 remains the longest in history, while the 1995–96 episodes totaled 26 days, and the 2013 shutdown lasted 16.

Each week of a prolonged shutdown is estimated to shave 0.1–0.2 percentage points off GDP growth. Beyond the numbers, the greater challenge is the ripple effect — furloughed workers, delayed federal contracts, and missing government data (including reports like jobs and inflation).

Mark’s Insight: “Shutdowns can feel dramatic in the headlines, but they’ve historically been more of a political event than a market driver. Unless this one drags on for weeks, markets tend to treat it as noise. The bigger risk is the lack of economic data, which complicates the Fed’s job. For investors, the lesson is clear: stick with strategy, not headlines.”

Stocks of the Week – Western Digital (WDC)

Western Digital has emerged as one of the notable stocks of 2025, soaring more than 200% year-to-date. Fueled by surging demand for high-capacity storage in AI, cloud, and enterprise applications, WDC has transformed from a cyclical hardware play into a leader in next-gen data infrastructure. Q4 results — $2.61B in revenue (+30% YoY) and EPS of $1.66 — confirmed the strength in its business and helped fuel the rally. Analysts continue to raise targets, with the high estimate now at $171.

Jackie’s Take: “Storage has become a critical piece of the AI and cloud infrastructure story, and WDC is benefitting in a big way. Shares are pressing fresh highs with RSI elevated at 85 and MACD in bullish territory. A breakout above $140 would mark another leg higher, while initial support sits near $128. It’s up 26% in just the past week, making it one of the biggest contributors in our Momentum model. The combination of strong fundamentals, powerful momentum, and bullish analyst sentiment reinforces why WDC continues to stand out.”

Quote of the Week

“Every man has two lives, and the second starts when he realizes he has just one.”

— Confucius

This perspective applies to wealth just as much as to life. At WWM, we help clients align their money with what matters most, cutting through the noise and focusing on the strategies that create lasting impact. Our Gather & Preserve™ framework and Layered Accounts are designed with this clarity in mind — prioritizing the essentials and eliminating distractions, so clients can fully live their “second life” with confidence.

What We’re Reading

Greg McKeown reminds us that exploration — creating space for rest and play — isn’t optional, it’s essential. Sleep sharpens decisions, play fuels creativity, and both create the margin needed to filter the “vital few” from the “trivial many.” In the rush of daily life, slowing down long enough to ask what truly matters is often the most productive step we can take.

WWM Insight: The same applies beyond business or investing — it’s about how we live. Too often we fill our days with activity, but not with meaning. Creating room for rest, play, and reflection isn’t wasted time; it’s the foundation for living intentionally. At WWM, we believe wealth should serve this same purpose — not just accumulating more, but creating the freedom to focus on what matters most in life

Disclaimer:

This commentary is provided for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any security. Past performance is not indicative of future results. All investments involve risk, including the possible loss of principal. The views expressed are those of Wolter Wealth Management and are subject to change without notice. Please consult with your financial professional before making any investment decisions.