Weekly Wrap Up: Sep 20-26, 2025

Weekly Wrap Up: Sep 20-26, 2025

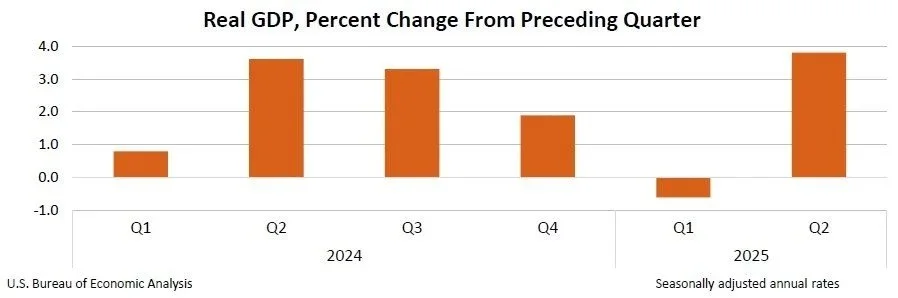

Chart of the Week: Stronger GDP Than Expected

The U.S. economy grew at an annualized pace of 3.8% in Q2, well above the 3.3% expected and the fastest pace in nearly two years. The revision was driven primarily by stronger consumer spending and a reduction in imports.

This robust growth underscores the resilience of the U.S. consumer despite higher rates earlier in the year and ongoing uncertainty around trade and global demand. But it also complicates the Federal Reserve’s path: after a rate cut last week, stronger growth could make policymakers more cautious about cutting too aggressively in the months ahead.

Mark’s Insight: “First estimates often get the headlines, but it’s the revisions that tell the fuller story. A 3.8% growth rate is impressive, and it reminds us that the economy can defy expectations. For investors, the lesson is clear: don’t anchor too heavily on early numbers or short-term predictions. Focus on what truly matters for the long run — building portfolios that are resilient through both surprises and slowdowns.”

Stocks of the Week – NVIDIA (NVDA)

NVIDIA remains in the spotlight as the market’s AI leader. The company’s GPUs continue to dominate data center buildouts and AI model training, keeping it at the center of one of the strongest growth narratives in tech. Recent headlines around expanded partnerships and robust enterprise demand have reinforced its leadership position, and investors continue to watch it as a key driver of sentiment across the semiconductor space.

Jackie’s Take: “AI infrastructure is one of the defining themes in today’s market, and NVIDIA is the clear leader. Shares are consolidating in the $170–180 range, with RSI at 52 after cooling from overbought levels and MACD holding in positive territory. A breakout above $180 could open the door to retesting prior highs, while support sits near $165. With both technicals and fundamentals aligning, NVDA remains one of the most influential stocks shaping sentiment in the AI trade.”

Quote of the Week

“The difference between successful people and really successful people is that really successful people say no to almost everything.”

— Warren Buffett

This week’s GDP surprise shows how unpredictable the economic path can be. Just as Buffett suggests, success comes from the discipline of saying no — to distractions, to noise, and to overreacting. Staying focused on what’s essential is what allows long-term strategies to endure.

What We’re Reading

This week, we started Essentialism: The Disciplined Pursuit of Less by Greg McKeown. Early in the book, McKeown challenges us to identify what is truly vital and to eliminate the trivial many. It’s a mindset shift: success doesn’t come from doing more, but from doing the right things consistently.

WWM Insight: In investing, this means not chasing every economic print or stock story. Instead, it’s about maintaining clarity, discipline, and focus — qualities that turn short-term surprises into long-term opportunity.

Disclaimer:

This commentary is provided for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any security. Past performance is not indicative of future results. All investments involve risk, including the possible loss of principal. The views expressed are those of Wolter Wealth Management and are subject to change without notice. Please consult with your financial professional before making any investment decisions.