Weekly Wrap Up: Sep 13-19, 2025

Weekly Wrap Up: Sep 13-19, 2025

Chart of the Week: The Fed’s Balancing Act

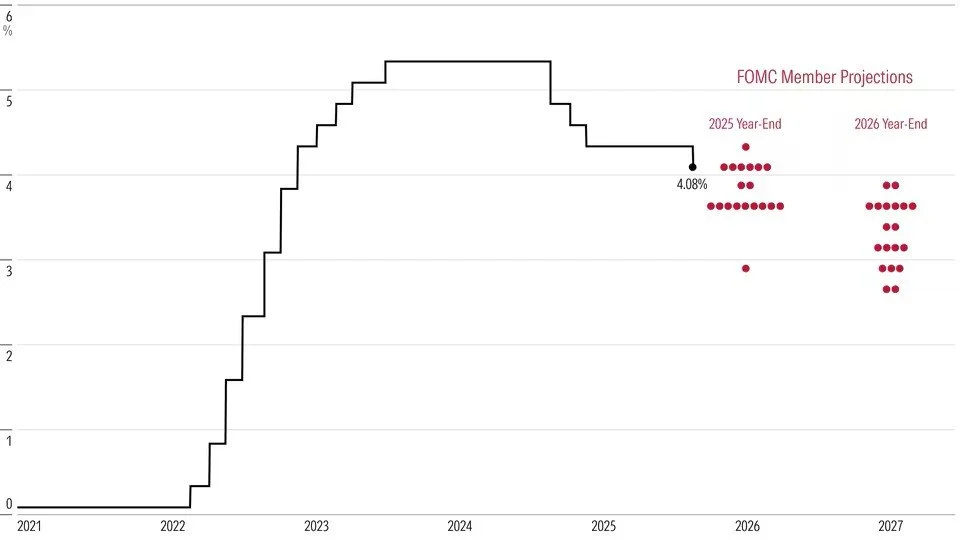

On September 17, the Federal Reserve cut the federal funds rate by 0.25%, lowering the target range to 4.00%–4.25%. This was the first cut since December 2024, a move Powell described as “risk management” in response to softer job growth and rising downside risks.

Alongside the decision, the Fed released its updated dot plot, which shows policymakers’ projections for where rates could head next. The majority of officials now anticipate two more cuts by year-end, while a smaller group expects either just one or a more aggressive pace. The split underscores the Fed’s delicate task of balancing elevated inflation with signs of cooling in the labor market.

Federal Funds Rate: Historical Data and FOMC Projections

Each dot represents one FOMC member’s federal funds rate forecast.

Mark’s Insight: “Rate cuts are often welcomed by markets, but Powell’s caution reminds us that there are no risk-free paths. The dot plot tells us how divided the Fed remains, which is a clear signal for investors: the path forward could shift quickly as new data comes in. For clients, the takeaway is not to guess the Fed’s next move but to have a portfolio strategy that is resilient whether the Fed cuts more aggressively or pauses to reassess.”

Stocks of the Week – CrowdStrike (CRWD)

CrowdStrike made headlines this week at its Fal.Con event, raising growth targets and reaffirming its $10 billion ARR goal by FY2031. The company also announced the acquisition of AI-security startup Pangea and a new partnership with Salesforce, underscoring its strategy to stay at the center of AI-driven cybersecurity. Shares are up 45% year-to-date, reflecting strong conviction in CrowdStrike’s execution.

Jackie’s Take: “Cybersecurity is one of the most important themes in tech, and CrowdStrike is positioning itself as the go-to AI security platform. It’s included in our Momentum portfolio, and the chart still looks strong — RSI is elevated at 74, MACD is in a bullish crossover, and price remains above its 50-day. Several analysts also raised their price targets above $500 this week, adding to the bullish sentiment. If shares can push through resistance around $515, it could set the stage for a breakout move higher. With fundamentals, technicals, and analyst support all lining up, CRWD continues to stand out as one of the most compelling names in cybersecurity.”

Quote of the Week

“There are no risk-free paths … It’s not incredibly obvious what to do.”

— Jerome Powell, September 17, 2025 FOMC Press Conference

What We’re Reading

From The Psychology of Money by Morgan Housel:

“Financial success is not a hard science. It’s a soft skill, where how you behave is more important than what you know.”

This captures one of Housel’s core messages—that building wealth isn’t just about spreadsheets and strategies, but about mindset, discipline, and behavior. In investing, it’s often less about predicting markets and more about managing our own reactions to them.

WWM Insight: Balance is the theme this week — from the Fed weighing inflation and jobs, to CrowdStrike testing resistance, to the reminder in The Psychology of Money that behavior matters more than knowledge. The takeaway is clear: markets will always shift, but it’s how we respond that makes the difference. Our role is to build resilient portfolios and guide clients through the emotions of investing, so you stay positioned with purpose no matter what comes next.

Disclaimer:

This commentary is provided for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any security. Past performance is not indicative of future results. All investments involve risk, including the possible loss of principal. The views expressed are those of Wolter Wealth Management and are subject to change without notice. Please consult with your financial professional before making any investment decisions.