WWM Weekly Wrap-Up: August 16-22, 2025

Chart of the Week – Housing Starts vs. Building Permits

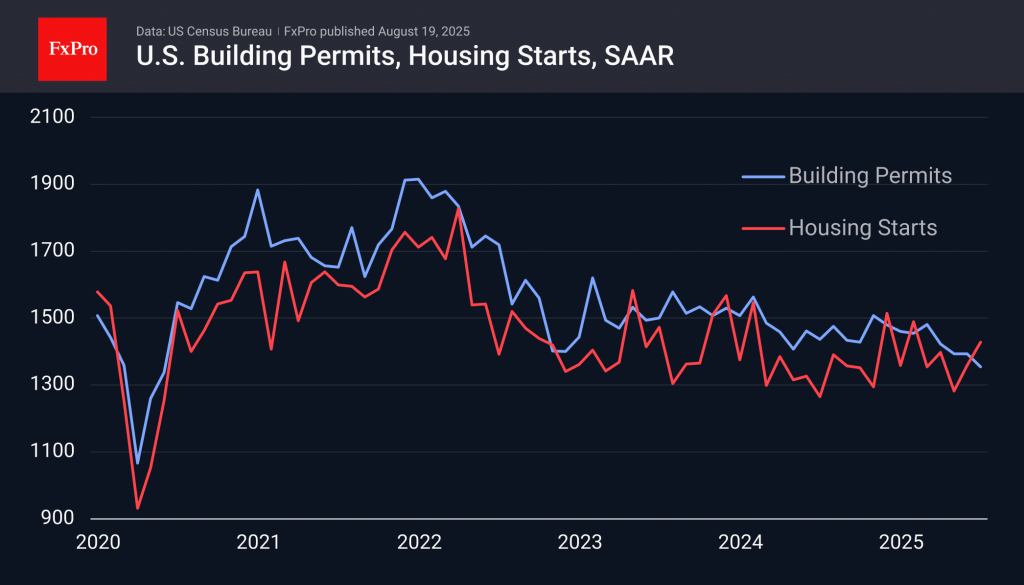

July’s housing data delivered a mixed picture:

Housing Starts rose to 1.43 million units (SAAR), up 5.2% from June and nearly 13% higher year-over-year. Multifamily construction led the surge, while single-family starts also posted modest gains at 939,000 units.

Building Permits, a forward-looking measure, fell to 1.35 million units, down 2.8% from June and 5.7% below last year. Single-family permits held steady, but multifamily permits dropped sharply.

The divergence highlights an important theme: builders are breaking ground on projects already in the pipeline, but fewer new permits suggest caution ahead. High borrowing costs, tighter credit conditions, and slowing demand may weigh on future construction activity.

Mark’s Insight: “Housing starts jumped in July, showing builders are still moving forward on projects already planned, but the drop in new permits tells a different story. Fewer permits mean future activity could slow, especially with high borrowing costs weighing on demand. This divergence is worth watching—it’s often an early signal of where the housing market, and broader economy, may be heading.”

Stock of the Week – Uber Technologies (UBER)

Uber announced Q2 2025 earnings on August 6, reporting revenue of $12.65 billion, up 18% year-over-year, with net income of roughly $1.4 billion and adjusted EBITDA rising 35% to $2.12 billion.

Alongside the earnings beat, management announced a massive $20 billion share repurchase program, nearly tripling its original buyback plan. Shares climbed more than 7% over the following sessions after earnings, with momentum carrying the stock toward new highs and cementing its leadership in the ridesharing and delivery space. The rally was further supported by a wave of analyst price target increases, adding to the strong post-earnings sentiment.

Jackie’s Take: “Uber remains a core position in select portfolios, and this week’s post-earnings rally only strengthened our outlook. The stock is pressing up against resistance around $97, and a clean breakout here could set it up for a run toward $100–$102. It’s trading solidly above both its 50- and 200-day moving averages, and momentum indicators remain supportive. With strong earnings growth, improving efficiency, and an aggressive capital return plan, Uber continues to stand out as one of the most compelling momentum names in our lineup.”

Quote of the Week

“The most important thing to do if you find yourself in a hole is to stop digging.” — Warren Buffett

What We’re Reading

From The Art of Thinking Clearly by Rolf Dobelli:

“No matter how much you have already invested, only your assessment of the future costs and benefits counts.”

This describes the sunk cost fallacy—the common mistake of holding onto something just because of what’s already been spent. In investing, it reminds us that markets don’t care what price we paid; only forward-looking opportunities matter.

WWM Insight: A timely reminder that discipline means knowing when to step back, cut losses, and reallocate to stronger opportunities.

General disclaimer:

This commentary is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security. Past performance is not indicative of future results. All investments involve risk, including possible loss of principal.

Holdings disclosure:

WWM and its clients may hold positions in the securities mentioned. Holdings are subject to change without notice.