WWM Weekly Wrap-Up: August 2–8, 2025

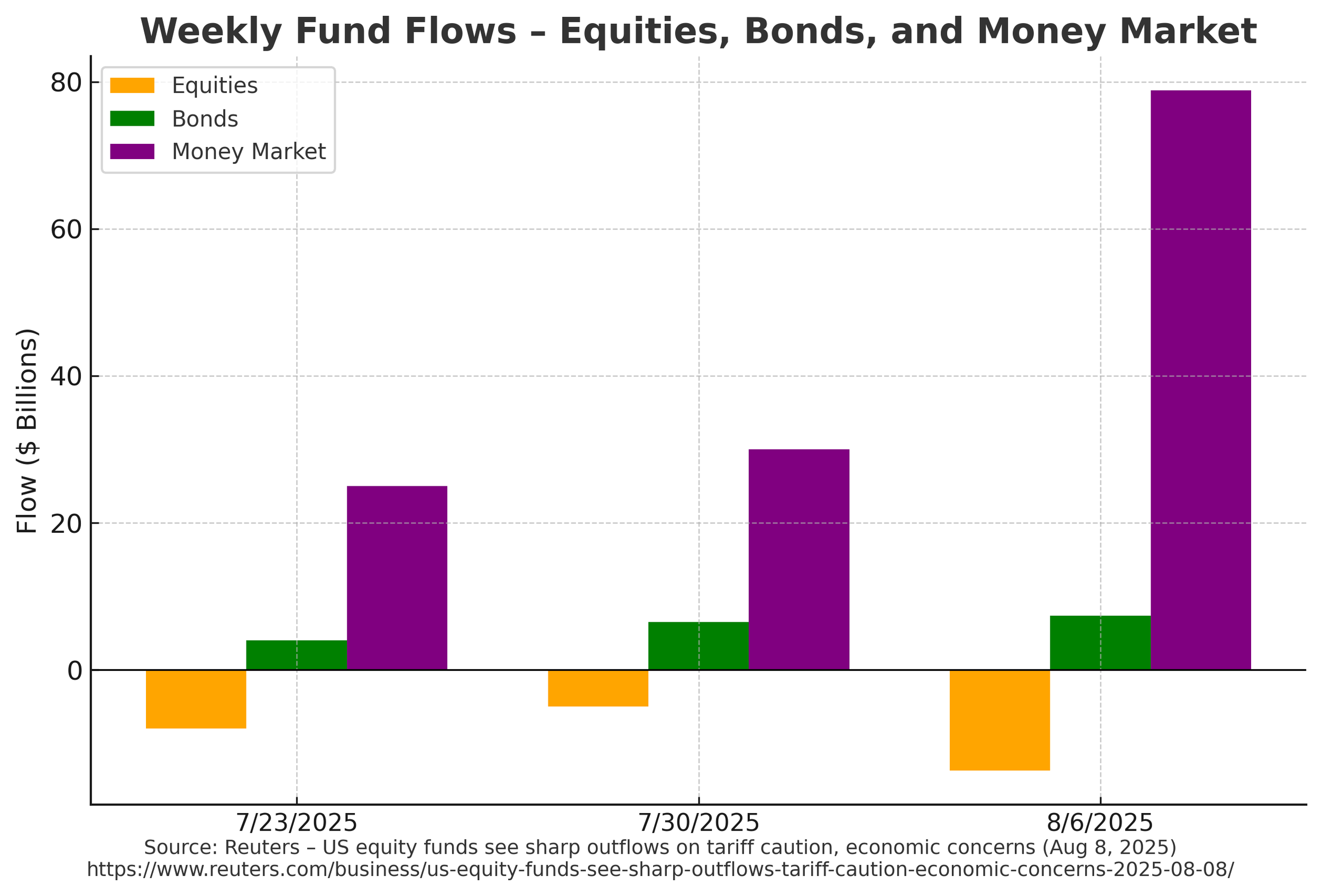

Chart of the Week – Flight to Safety

U.S. equity funds saw $13.7 billion in outflows this week — the biggest since late June — while money market funds took in $78.9 billion, the largest inflow since December 2024. Bond funds also saw strong demand, especially in investment-grade and municipal debt.

Mark’s Insight: “Investors are positioning more defensively amid tariff concerns and softer market sentiment — a setup that can create opportunities for patient, disciplined investors.”

Stock of the Week – Palantir (PLTR)

Palantir reported earnings on Monday, delivering Q2 revenue of $1.004 billion — a 48% year-over-year increase — and raised full-year guidance. The stock surged more than 20% this week, breaking out to new highs and continuing its sharp uptrend.

Jackie’s Take: “PLTR remains a key holding in select portfolios, and this week’s breakout only reinforced our thesis. The stock remains well above both its 50- and 200-day moving averages, with a recent MACD crossover and RSI in bullish territory. With growing traction in AI and continued strength in government contracts, Palantir continues to stand out as one of the most compelling momentum names in our lineup.”

Quote of the Week

“Risk means more things can happen than will.” — Elroy Dimson

What We’re Reading

This week, we’ve been diving into Money: Master the Game by Tony Robbins. One key takeaway: Robbins emphasizes the importance of creating a lifetime income plan—allocating a portion of your portfolio to produce steady, reliable income regardless of market conditions. He draws from interviews with top investors like Ray Dalio, who stress diversification across asset classes, geographies, and time horizons to help weather volatility without sacrificing growth potential.

WWM Insight: It’s not just about chasing returns—it’s about structuring your money to serve you for life, through both bull and bear markets.

General disclaimer:

This commentary is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security. Past performance is not indicative of future results. All investments involve risk, including possible loss of principal.

Holdings disclosure:

WWM and its clients may hold positions in the securities mentioned. Holdings are subject to change without notice.